Over the past few years, the TON ecosystem has been steadily shaping itself into a practical infrastructure for transfers, micropayments, and everyday financial operations. Interest in TON is driven not only by Telegram’s massive user base, but also by how the blockchain is gradually embedding itself into familiar user scenarios — from sending funds inside apps to interacting with services and bots. This shift from speculative hype toward real-world usage is what makes the TON future particularly compelling in the coming years.

In this article, we examine the future of TON in 2026, focusing on its long-term outlook and the role that actual adoption — rather than market noise — is likely to play.

The Current State of The Open Network: Why Everyone Is Talking About TON

The Open Network belongs to the category of Layer-1 (L1) blockchains. This means the network processes transactions directly, without relying on external solutions or add-ons. Ethereum and Solana are also L1 networks. For users, this matters: transaction speed, fees, and security are all determined by the base blockchain itself.

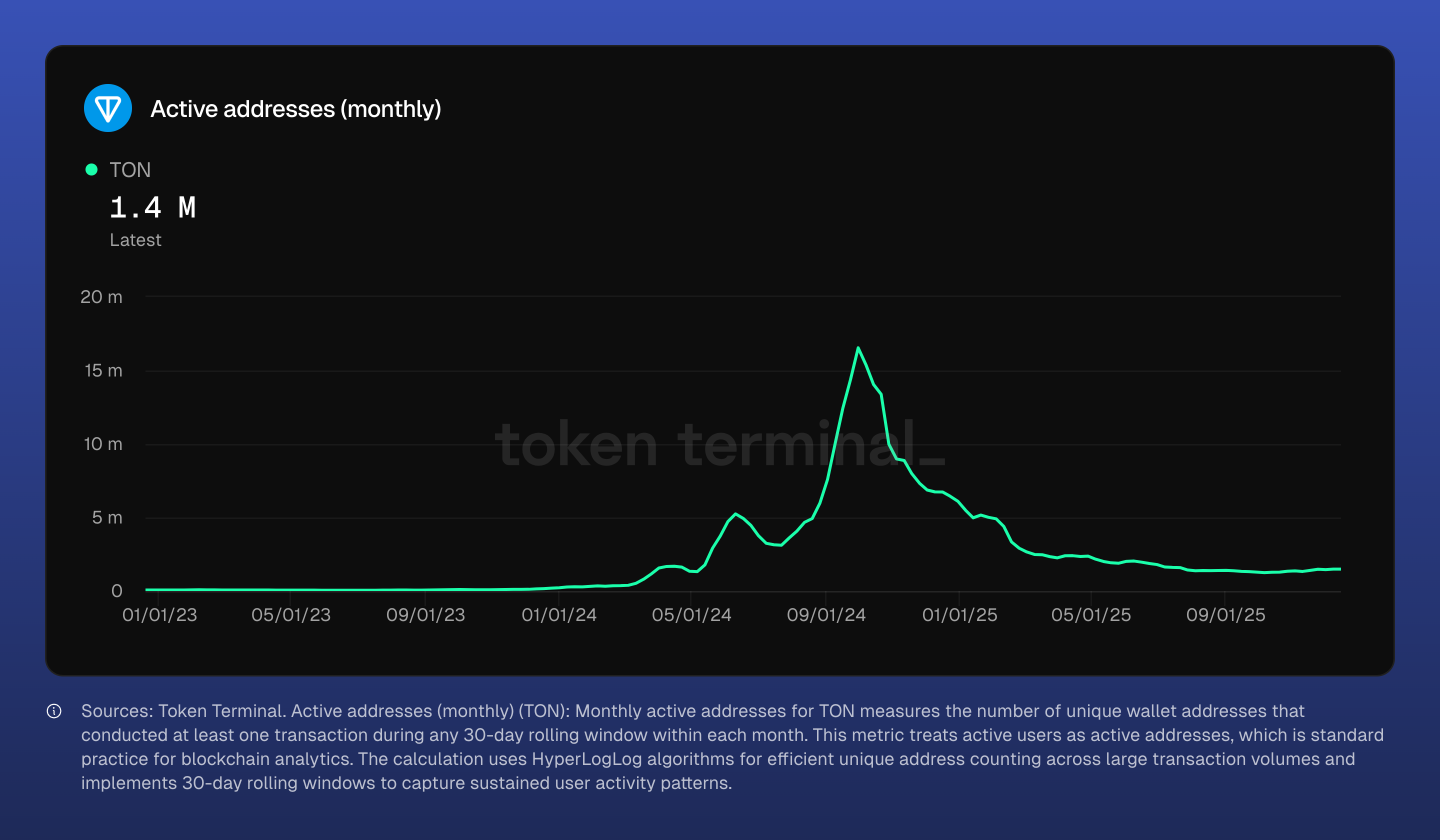

According to publicly available analytics, TON already ranks among the most heavily used L1 networks. It processes several million transactions per day, with roughly 50 million wallets created overall. Daily active addresses are measured in the hundreds of thousands, and this metric has grown severalfold over 2024–2025.

The main driver behind this growth is Telegram integration. Mini Apps inside Telegram — including gaming projects like Notcoin and Catizen — have become an entry point into crypto for millions of users. These are not exchanges or traditional companies, but built-in Telegram services where users earn tokens for simple actions. For many, this is their first interaction with blockchain technology, and TON is the network powering these transactions. This dynamic forms the foundation of the TON cryptocurrency future outlook.

What Will Drive TON Coin's Growth Through 2026?

Instead of guessing about the price, it makes sense to the demand factors. The key things to watch are payments, stablecoins, and how well TON works with other blockchains. These will be the main supports for the network in 2026.

Stablecoins and Simple Payments

TON is becoming a go-to for payments and moving money around. It already works with stablecoins like USDT and USDe in popular wallets. You can send money right in Telegram chats, with no confusing steps.

One cool thing is that Tether is putting stablecoins backed by real assets like gold on TON. These aren't for risky trading; they're about making payments easier and more reliable on the blockchain. By 2026, expect to see more money locked up in TON as stablecoins become a bigger part of Telegram Wallet, letting users earn rewards by staking.

All this makes TON coin more useful as a way to pay, not just something to trade.

DeFi and Connecting to Other Blockchains Made Easy

TON's DeFi scene is getting simpler. Big decentralized exchanges on the network already let you trade tokens easily, and you can move assets between TON and other blockchains.

This cross-chain thing means you can move your assets around without dealing with complicated bridges or doing things by hand. For example, you can trade TON assets for tokens on TRON or blockchains that work with Ethereum. This makes things cheaper and easier, so more people can use the network.

By 2026, TON's DeFi could have around $1 billion locked up, thanks to new token options and quicker transfers.

Technical Architecture and Tokenomics

TON was designed as a highly scalable network. Its architecture supports parallel transaction processing, with stress tests demonstrating throughput exceeding 100,000 TPS. For users, this translates into fast confirmations and consistently low fees, even during periods of high network load.

The total supply of TON is approximately 5.14 billion tokens. Annual inflation remains in the range of 0.55–0.6%. Newly issued tokens are partly allocated to staking, while a portion of transaction fees is burned. The average transaction fee is around 0.005 TON — equivalent to just a few cents.

This model means the the open network TON future outlook is closely tied to actual network activity rather than artificially engineered scarcity.

TON Price Outlook: Possible Scenarios for 2026

When discussing price, it is more accurate to speak about scenarios rather than specific numbers. The future of TON will largely depend on how actively the network is used in practice.

Optimistic Scenario (Bull Case)

In a positive scenario, Telegram continues scaling Mini Apps and embedded payment features. An additional catalyst is Telegram’s cooperation with xAI — Elon Musk’s artificial intelligence company — as part of a $300 million deal that includes both investment and revenue-sharing from Grok subscriptions.

The practical impact here is not artificial intelligence itself, but infrastructure. Data analysis tools and AI-powered services rely on micropayments, fast settlements, and transparent transactions. In this scenario, TON acts as the base settlement layer. As Mini Apps and services grow, network usage increases, strengthening demand for the token. This makes the TON future in 2026 structurally resilient rather than purely speculative.

Pessimistic Scenario (Bear Case)

There are already signs of a slowdown. Daily transactions declined from a peak of 4.3 million in December 2024 to around 2 million by December 30, 2025 — a drop of 53%. Active wallets fell from 880,000 to 116,000, representing an 87% decrease. DeFi TVL dropped by more than 50% since July 2025, from $770 million to roughly $400 million.

In a negative scenario, regulatory pressure on Telegram services and declining interest in Mini Apps could worsen the trend. TVL could fall by another 40–50% (to $200–250 million), while daily transactions may decline to 1.5–2 million — levels last seen in early 2025.

With reduced activity, network load decreases, weakening demand for the token. In that case, the TON coin future outlook would depend entirely on the ecosystem’s ability to retain users, attract developers, and adapt to external constraints.

How TON Works: Transfers and Payments

TON started as a quick payment method within Telegram, so people mostly use it for transfers and daily payments. Transactions are super-fast, finishing in under a second, and fees are really low, like a few cents. You don't need other apps or annoying setups. That makes TON handy for Mini Apps, bots, and sending money to friends.

Most folks get TON through Mini Apps and those click-to-earn games. Then, they usually do one of three things: send TON to others, pay for stuff on Telegram, or trade TON for stablecoins to use elsewhere.

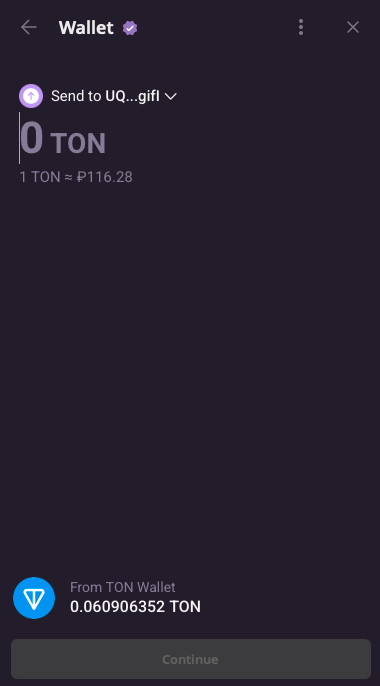

To send TON on Telegram, just open the wallet, hit Send, and type in the other person's address or Telegram username. It usually takes a second or two to confirm, and the money goes straight to them.

Within Mini Apps and bots, TON serves as a unit of account. After completing tasks or in-game actions, users press a claim button and connect a wallet via TonConnect. Tokens are credited automatically, provided there is a minimal TON balance available to cover network fees.

TON does not have to be held in its original form. Inside the wallet, it can be swapped into stablecoins such as USDT or USDe to lock in value or prepare assets for transfers to other networks. This is why many users move on to the next step after earning rewards in Mini Apps — withdrawing TON through cross-chain exchanges via TR.ENERGY for further use.

How to Withdraw TON from Mini Apps to TR.ENERGY: Step-by-Step

Withdrawing TON from Mini Apps takes only a few minutes and requires no technical expertise. The key is understanding the sequence of actions and preparing the receiving wallet in advance.

Step 1. Connect a TON Wallet to the Mini App

Open the Mini App in Telegram and tap “Wallet” or “Claim.” Select “Connect Wallet” and authorize via Telegram Wallet (@wallet) or Tonkeeper. Once confirmed, the connection is complete and the earned TON will appear in your wallet balance.

Step 2. Check Your Balance for Network Fees

Before withdrawing, make sure your wallet has a small amount of TON to cover network fees. Typically, 0.01–0.05 TON is sufficient to pay gas costs for swaps and transfers.

Step 3. Create a Wallet in TR.ENERGY

Install the TR.ENERGY Wallet app from an official source. During setup, create a PIN code and securely store your seed phrase. Then open the receive section and copy your USDT address on the TRC-20 network.

Step 4. Swap TON and Transfer to the TRON Network

In Telegram Wallet, select TON and open the swap section. First, exchange TON for USDT on the TON network. Then choose to send the funds to an external wallet, select the TRC-20 (TRON) network, paste the TR.ENERGY address, and confirm the transaction. Transfers usually take from one to several minutes.

Step 5. Use Funds Inside TR.ENERGY

Once USDT TRC-20 is credited to your TR.ENERGY wallet, you can use it for transfers, withdrawals to exchanges, or other operations. To reduce transaction fees for future activity, energy rental is available.

Should You Run AML Checks on Tokens From Bots?

AML (Anti-Money Laundering) checks are used to assess whether crypto assets are linked to fraud, hacks, or illicit activity. This analysis tracks token history and on-chain movements.

When receiving TON through bots and Mini Apps, users often have no insight into the origin of those funds. Some tokens may carry elevated risk. AML checks help identify such cases in advance and reduce the likelihood of blocks during swaps or withdrawals.

Conclusion

TON’s development is driven not by loud announcements, but by everyday usage: transfers, Mini Apps, and in-chat payments within Telegram. This sets it apart from networks focused exclusively on DeFi or trading.

If the ecosystem maintains its momentum in 2026 and continues expanding payment and cross-chain scenarios, the TON cryptocurrency future outlook will be defined not by market expectations, but by real network load — historically the most sustainable growth model.